It is critical to surround yourself in life with the right folks. A sensible mentor. An encouraging best friend. And, yes, even a really fantastic tax adviser.

After all, once the stress of tax period starts to smother you in its own freezing cold embrace, right would like an honest tax ace onto your negative? Somebody who will be able to help you solve all your tax concerns and problems? Ofcourse you need to are doing!

But finding a tax adviser you may count on is not as simple since it was. So, exactly what will one trusted tax consultant appear to be? And how can you will find you nearby you?

We're going to do a deep dive around the critical attributes and matters to start looking for in a tax pro. But , let us look at why you want one from the very first spot.

Why Use a Tax Advisor?

Tax yields really are similar to best tax preparer near me snowflakes--no 2 are alike! From the number of children you have running across the house to those strange jobs you took this past year to pay off debt quicker, there are dozens of factors that'll impact simply just how far you'll owe to Uncle Sam and simply how much you can save on your taxes from year to year.

Some people have a simple situation--they can file their taxation with some online tax software. But periodically you're be pleased you looked to a pro for assistance.

Here are some Explanations for Why you Most Likely Want to consider working using a tax advisor this past year:

You went through a big life shift. Got married? Had an Infant? Congrats! Your tax problem is probably going to change, so you'll wish to give your tax expert a call once you are straight back from your honey moon or fully stocked upon leftovers.

You'd countless resources of revenue or started a enterprise. That additional money you got in sending your wedding pictures firm really is equally fine! But this also means that you may need to address different tax forms along with issues you have not dealt with previously.

You're focused on maybe not having your taxes done right. There aren't many words from the English terminology that are scarier when put with each other than"tax audit" After all, nobody wants to have their financial existence picked besides the IRS. Possessing an tax adviser to direct you and help you file your own taxes accurately will permit you to breathe somewhat easier as soon as Tax dawn has arrived and gone.

Still not sure whether or not you need to become in touch with a tax advisor this past year? Require our taxation score and figure out which choice is ideal for you--it'll only have several minutes!

What Do You Need to Seek in a Home Advisor?

Let's face itTaxes are somewhat complicated because they are very boring. If you are experiencing difficulty sleeping at night, then get a copy of this U.S. tax code and then only begin reading through. That'll knock out you real fast.

But tax advisors--the good onesaren't like the others of us. They still live , eat and breathe this substance. They're up-to-date with all the most recent developments and changes taking place in Tax World therefore they will be able to let you understand that tax laws, deductions and credits affect you personally.

But searching to get a tax ace goes past venture understanding. Listed below are eight important attributes You Need to Always look for in a tax adviser before you agree to trust them with your taxation:

1. They're qualified and possess the right certificates.

Once you are searching to get a tax pro, you're going to desire to do the job with somebody that will give you quality advice. Quite simply they know what the flip they're performing!

When it comes to Obtaining tax information, find a pro who has one of Those two certificates:

Enrolled Agent: An Enrolled Agent is an tax specialist for people looking for expert tax return prep and tax information. Furthermore, they are certified by the IRS to represent you if you're being audited.

Licensed Public Accountant (CPA): Accredited Public Accountants specialize in tax planning and planning, but they could also offer a whole lot of different services to help you throughout the whole year --by bookkeeping to longterm financial planning. If your tax situation is actually intricate, a CPA will assist with information on taxation plans to follow along in accordance with your own circumstances.

Enrolled Agents and CPAs both go through extensive training, testing and continuing training to keep up their credentials and stay up-to-date on tax laws and regulations that they are able to better serve you. Somebody with just a preparer tax identification number (PTIN) is not planning to minimize it.

Interesting reality: Every one among those tax Endorsed Local Providers (ELPs) is either an Enrolled Agent or a CPA. That means once you utilize an ELP, then you may take a break sure that you are dealing together with a first-class expert!

2. They can be purchased all year.

Now, there are a whole lot of part-time, fly-by-night tax preparers popping during tax year simply to disappear after they record your tax returnand never to be heard from . Not even on a Christmas card.

Just like we stated, things take place during this year that can have a major influence on the best way to record your taxes for this tax year. When life occurs, having a reliable tax ace that will pick up the phone to reply to your tax problems from September (perhaps not simply January during April) may effect a tremendous difference.

3. They understand your financial goals.

Wherever you are about the Baby Steps, it helps to possess a tax adviser who is on an identical wavelength when you. This means that they take some time to learn about you personally as well as your economic targets, so they can supply you with tax ideas which may drive you closer to attaining those aims.

Whether they truly are working out for you pay off credit card debt faster through the entire season by fixing your withholdings or even giving you assistance to identify probable pros and cons of taking the negative hustle into the following stage, then a good tax adviser is a person who's always on the lookout for tactics to assist you to proceed the ball farther down the area.

4. They make time to reply to your tax questions.

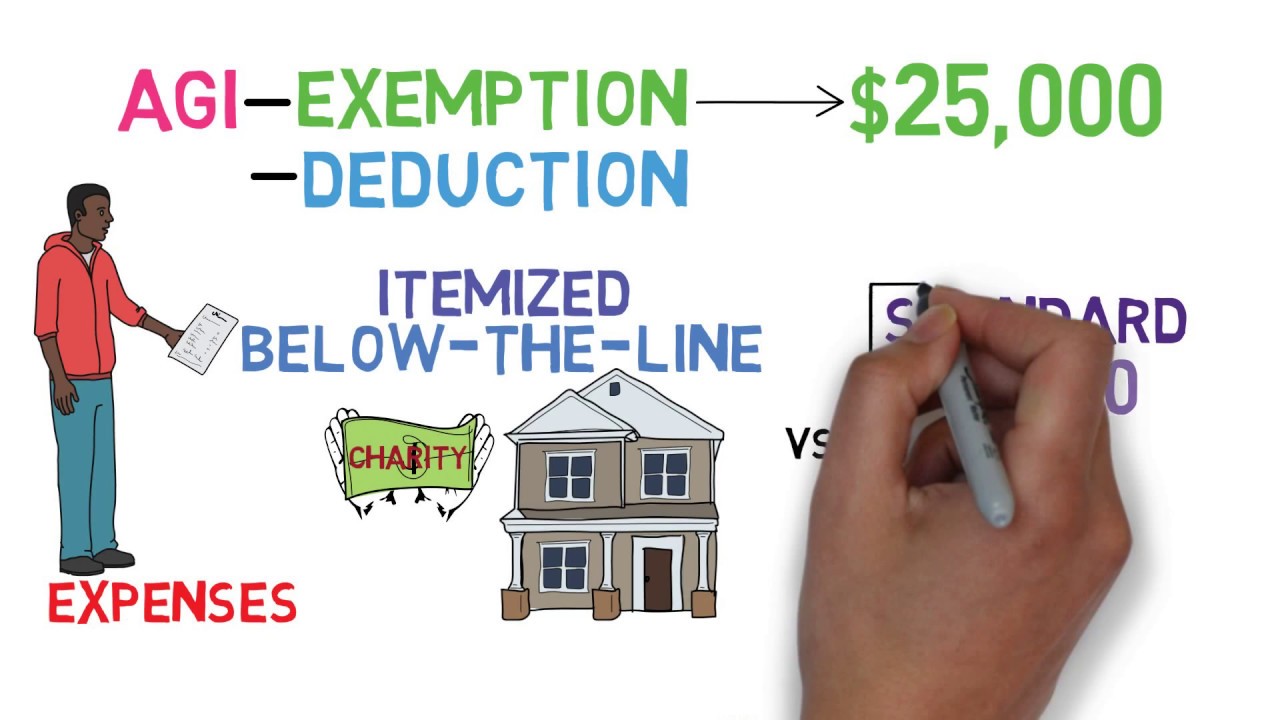

If tax provisions such as"deductions" and also"itemizing" and"Adjusted Gross Income" start getting thrown round, your head probably commences to flooding with concerns. Don't worry, this is a wholly normal reaction.

Your tax adviser must remain ready to sit with you and help you answer all of your questions about your taxes. That is what this means to have one's core of the teacher!

In the event you are requesting questions along with also your tax adviser rolls their eyes or provides you with a high-browed reply that leaves you more confused than you were earlier, it's probably time for you to start looking for a brand new adviser.

5. They've been more proactive in communication with you.

That you don't simply want someone who places a rubberstamp onto your return and walks off. That is merely idle. You necessitate a tax expert who is going to select the initiative to maintain an eye out for things which you might need to change for the upcoming calendar year.

Did you get a big refund? No one would like to give the authorities an past-due loan. Have you ever seen the way they deal with currency? A superb tax ace may choose the opportunity to explain that your company has already been taking too much money out of one's paycheck for taxation and explain just how to repair it.

Or what if you got slapped with a significant tax invoice? Your pro needs to have the ability to explain why that has been the case and the way you can avoid becoming caked next year.

6. They will be able to assist you with small business taxation.

When you have a small company or if you should be considering starting one , it really is easy to just forget by what that means when it comes to your earnings. However, you're be happy you have a tax expert with experience dealing together with small-business owners and can allow you to navigate through small business taxation rates, believed taxation and deductions you qualify for as a company owner.

7. They can assist you along with your taxation following 12 months... and the season then.

Possessing a tax adviser you may turn annually in year out can help you save you from needing to explain precisely exactly the very exact same items over and repeatedly to a fresh arbitrary tax preparer each and each spring. Who's time for it?

Anyway, it helps to possess a tax adviser who is aware of you as well as your taxation case well enough to provide you solid advice and tips that will assist you decrease your tax statement.

8. They can be trusted with sensitive info regarding your finances.

Working with a friend or relative to your own taxes might be tempting, but do you really want Uncle Joey to know how much you make, what size your mortgage loan is and sometimes even how far you really tithe to your own church? This can make Thanksgiving dinner type of awkward!

It is imperative that you locate a tax advisor you may expect with all the nuts and bolts on your own financial circumstance. Trust may be the foundation of any powerful romantic relationship --for example your own relationship with your tax pro!