It is necessary to surround yourself with the correct people. A sensible mentor. An encouraging best friend. And, yes, even a really wonderful tax adviser.

After all, once the stress of tax period starts to smother you in its own arctic cold adopt, but not want a reliable tax pro on your side? Someone who can help you solve your entire tax issues and issues? Ofcourse you need to are doing!

But locating an tax adviser you can count on is not as easy because it was. So, what will a trustworthy tax adviser appear to be? And just how would you find one nearby you?

We're definitely going to execute a deep dip on the important characteristics and things to search for in a tax pro. But , let us take a look at why you want one from the very first place.

Why Assist a Tax Advisor?

Tax returns really are like snowflakes--no two will be alike! From the number of kiddies you have running round your home to those odd jobs you chose this past year to cover debt off faster, you'll find scores of factors that can impact how much you are going to spend to Uncle Sam and simply how far you can save on your taxes annually to year.

Some people have a simple situation--they can file their taxation with some on-line tax software. But periodically you are going to be glad you turned to a pro for help.

Here are some Explanations for Why you Most Likely Want to Look at Dealing using a tax advisor this specific season:

You moved through a big life shift. Received married? Had an Infant? Congrats! Your tax problem is likely to vary, and that means you're going to want to present your tax expert a telephone once you are straight back from your honeymoon or completely hauled upon diapers.

You had countless origins of revenue or started a small business enterprise. That additional cash you got out of delivering pizzas or your new wedding photography firm will be fine! But that entails you might have to manage different tax forms along with issues which you have not dealt with in the past.

You're focused on maybe not getting the taxes done correctly. There are few words in the English language which are scarier when placed together than"tax audit" Afterall, no one would like to have their monetary living picked besides the IRS. Possessing a tax advisor to guide you and help you record your own taxes correctly will allow you to breathe somewhat easier once Tax dawn has come and gone.

Still uncertain whether you need to acquire in touch with a tax advisor this past particular year? Take our tax quiz and also figure out which solution is ideal for you personally --it'll only take several momemts!

What Should You Look for in a Tax Advisor?

Let us deal with itTaxes are somewhat complicated as they are very boring. If you're having trouble sleeping during the night, then pick up a copy of this U.S. tax code and simply start looking at. That'll knock you out real quick.

But tax consultants --that the good onesaren't like the others of us. They live, eat and breathe this material. They are up-to-date with each of the latest changes and trends happening in Tax earth therefore that they can help you realize which tax legislation, credits and deductions affect you personally.

However, looking to get a tax ace goes past venture knowledge. Here are eight important qualities You Always Need to look for in a tax adviser before you consent to trust them with your taxation:

1. They are qualified and also have the most suitable certificates.

Whenever you're on the lookout for a tax ace, you are business tax preparer near me definitely going to want to get the job done with somebody who will supply you with quality advice. Put simply , they understand what the reverse they are accomplishing!

When it comes to getting tax information, locate a pro with just one of the 2 certificates:

Enrolled Agent: A Enrolled Agent is a tax specialist for people looking for professional tax return preparation and tax information. Additionally, they've been licensed by the IRS to represent you when you should be staying audited.

Certified Public Accountant (CPA): Accredited Public Accountants concentrate on tax preparation and planning, but they could also provide a bunch of different services to help you during the whole year --from accounting into long term financial planning. If your tax problem is actually difficult, a CPA will aid with advice on taxation strategies to follow based on your circumstances.

Enrolled brokers and also CPAs go through comprehensive training, schooling and ongoing training to keep up their qualifications and keep up to date on taxation laws and regulations so that they could better last. Someone with only a preparer tax identification number (PTIN) isn't planning to reduce it.

Fun reality: Every one among our taxation Endorsed neighborhood suppliers (ELPs) is either an Enrolled Agent or a CPA. So when you work with an ELP, you can rest sure that you're working with a top-notch expert!

2. They are available annually.

Now, there are a lot of part-time, fly-by-night tax preparers showing during tax time simply to evaporate once they document your tax returnand never to be heard from . Not even on a Christmas card.

Just like we stated, things happen through this season that can have a significant influence on the best way to record your own taxes for this tax year. If life occurs, acquiring a trustworthy tax ace that will pick the phone up to respond to your tax questions in September (maybe not just January through April) can make a substantial impact.

3. They understand your financial objectives.

Wherever you are around the infant Measures, it helps to own a tax adviser who's on an identical wavelength as you. This way that they have some time to know about you and your money goals, therefore they may supply you with tax tips that may induce you nearer to reaching those goals.

Whether they're helping you repay debt faster through the entire year by correcting your withholdings or assisting you to identify likely pros and cons of taking the unwanted hustle to the following stage, then a excellent tax advisor is somebody who is ever searching for tactics that will help you proceed the ball farther down the field.

4. They create time to reply to your tax questions.

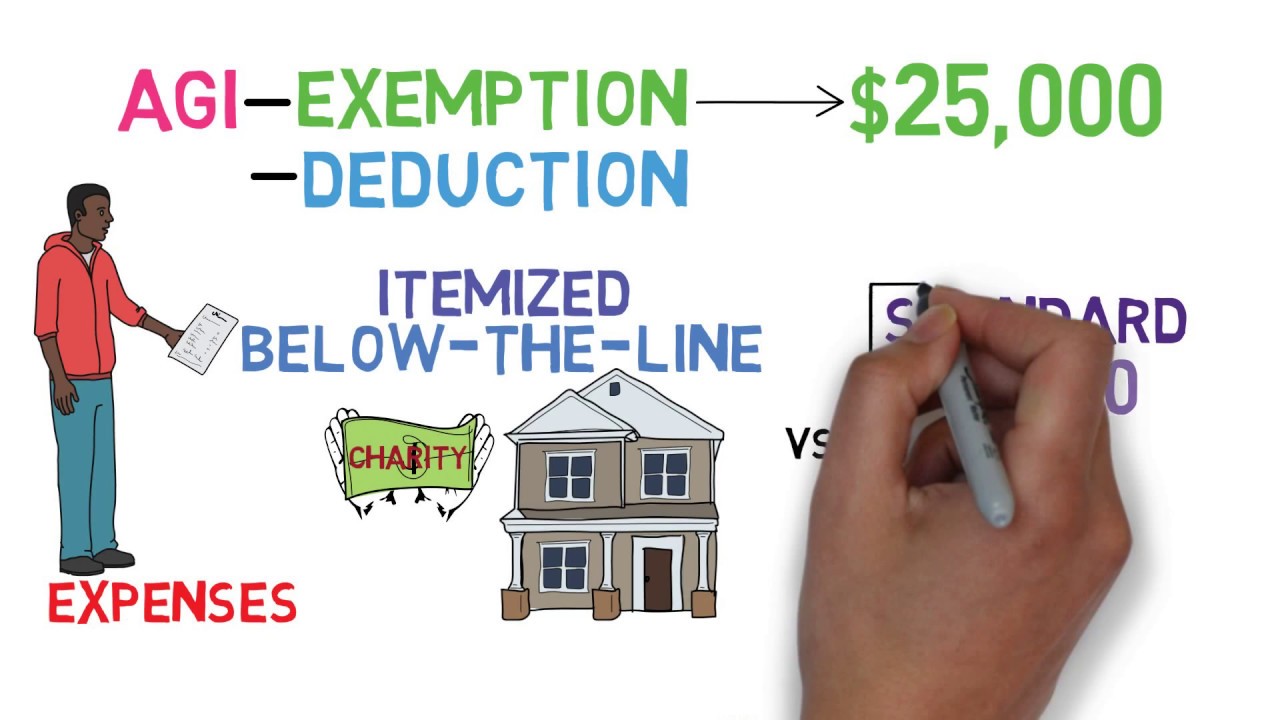

If taxation terms such as"deductions" and"itemizing" and"Adjusted Gross Income" begin getting chucked round, your head probably starts to flooding having questions. Do not worry, this is a totally ordinary reaction.

Your tax adviser must remain prepared to sit down with you and allow you to answer all your concerns about your own earnings. That's what this means to have the core of a instructor!

In the event you are requesting questions and also your tax adviser rolls their eyes in the office or gives you a high-browed reply that renders you confused than you have been before, it's likely time to start looking for a brand new adviser.

5. They are more proactive in communicating with you.

You really do not simply want a person who places a rubberstamp onto your return and walks away. That's simply lazy. You desire a tax ace who will take the initiative and keep a look out for items that you might have to improve to the upcoming year.

Can you get yourself a major refund? Nobody wants to provide the authorities an past-due loan. Have you ever seen how they cope with currency? A good tax pro will choose enough time to explain your company has already been taking too large an amount of money outside of one's paycheck for taxes and also demonstrate the best way to repair it.

Or suppose you have slapped with a large tax invoice? Your expert should have the ability to spell out why that was the case and how you can avoid getting blindsided next calendar year.

6. They can help you with small business taxation.

In the event you are in possession of a little business or if you're considering starting you , it is simple to forget by everything that indicates when it comes to your taxes. Nevertheless, you're be glad you own a tax expert who has experience working with smallbusiness owners and can allow you to browse through business taxation rates, approximated taxes and deductions you meet the requirements for a small business proprietor.

7. They can help you with your taxation following year... and the season then.

Possessing a tax advisor you may turn to year in year out can save you from having to describe exactly the exact points over and over again to some fresh arbitrary taxation preparer just about every spring. Who has time for it?

In any case, it helps to own a tax advisor who knows you along with your tax case enough to offer you solid advice and tips to assist you decrease your tax bill.

8. They are sometimes trusted with sensitive information about finances.

Working together with anybody you like on your taxes might be tempting, however you might not want Uncle Joey to know how much you make, what size your home loan is and even how much you tithe to your own church? That could make Thanksgiving supper kind of awkward!

It's imperative that you find a tax advisor you can trust with most of the nuts and bolts of your own financial situation. Trust may be the foundation of any solid romance --for example your own relationship with your tax pro!